cryptocurrency tax philippines

These situations may include but are not limited to multiple sources of business income large amounts of cryptocurrency transactions taxable foreign assets andor significant foreign investment income. The major tax myths about cryptocurrency debunked.

Philippines And Cryptocurrency Virtual Currency Laws Freeman Law

Because Cryptocurrency works on decentralised assets in Philippines things like interest rate changes and political instability do not affect cryptocurrencies as much as the currency markets in Philippines for example.

. From January 1 2023 a new compensation tax rate regime will be adopted in the Philippines reducing income tax by. Using CoinTracker and change the tax lot ID method to highest-in-first-out HIFO will result in the least amount of gains. It can be very lucrative to sell your products online because it lets you operate your business without a traditional shopfront.

However Congress has not yet passed a digital taxation measure which would impose tax. Tax Planning Strategies. Recently virtual currencies were legalized and cryptocurrency exchanges are now regulated by Central Bank of the Philippines Bangko Sentral ng Pilipinas under Circular 944.

However bitcoin and other virtual currencies are not recognized by the BSP as currency as it is neither issued or guaranteed by a central bank nor backed by any commodity. The government itself is already meddling in cryptocurrency by setting up blockchain app bondsph with Unionbank to distribute government bonds. The evolution of cryptocurrency In recent years cryptocurrencyand in particular Bitcoinhas demonstrated its value now boasting 14 million Bitcoins in circulation.

Provides independent substantive evidence of the private key and public address pairing which is needed to establish ownership of cryptocurrency. Investors speculating in the future possibilities of this new technology have driven most of the current market capitalization and this is likely to remain the case until a. The number of regulated cryptocurrency exchanges in the Philippines has grown to 16 according to Bangko Sentral ng Pilipinas the countrys central.

Check our latest articles now. VATupdate - Daily VAT including GST sales tax consumption tax etc news from around the world. Being tax exempt may cut your taxes but it can cause trouble if you dont know how it works.

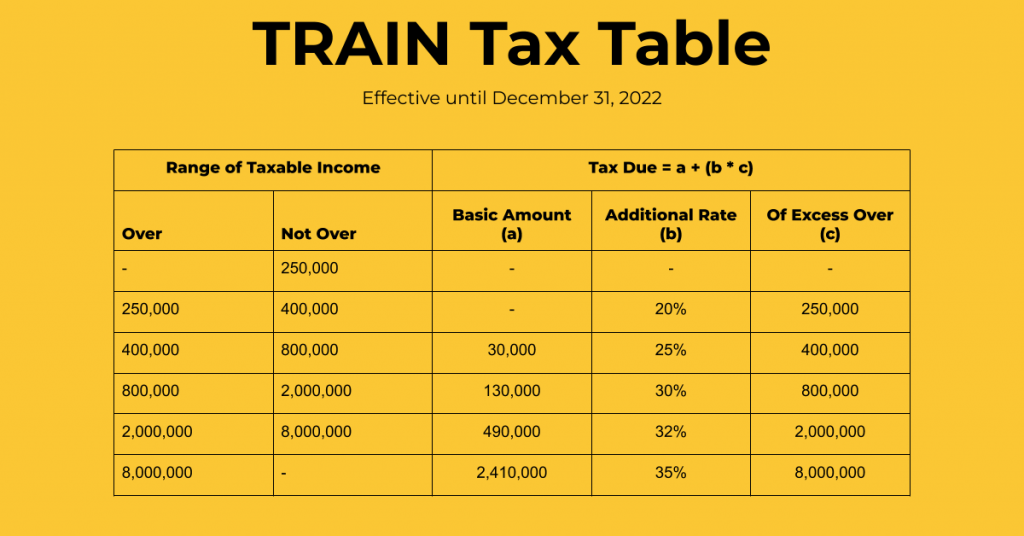

Certain complicated tax situations will require an additional fee and some will not qualify for the Full Service offering. Estate Tax is a tax on the right of the deceased person to transmit hisher estate to hisher lawful heirs and beneficiaries at the time of death and on certain transfers which are made by law as equivalent to testamentary disposition. When it comes to freelance tax in the Philippines your annual and quarterly income taxes are required to be filed and paid based on tax income rates ranging from 5-32 prescribed by the BIR.

In an environment where robust controls have been proven effective throughout a business crypto currency activities our Halo solution. Cryptocurrencies are taxed as capital assets making them eligible for a 0 long-term capital gains tax rate. Austria Plans Cryptocurrency Tax for 2022.

P5000 P10000 Monthly Income. Best Small Business Ideas in the Philippines Editors Picks 1. Philippine Leader Moots Killing of Pharma Execs Over Tax Evasion.

MANILA PHILIPPINES Continuing to revolutionize how Filipino self-employed professionals freelancers and small business owners file and pay taxes the Philippines pioneering BIR-accredited online tax filing and payment platform Taxumo now accepts cryptocurrency for tax payments. Cryptocurrency mining should be officially recognized as a business activity and taxed Russian media reports citing officials. Quarterly taxable net income is the differentiating factor between business expenses and gross receipts.

Our team is comprised of cryptocurrency investors from all over the globe and our members come from traditional industries such as finance and engineering to more modern professions like full stack developers and data scientists. Filipinos are known to the world as resilient and extremely hardworking people. With this best case in mind lets look at seven ways you can legally earn or.

Tax exempt means some or all of certain income isnt subject to tax. CryptoManiaks is an authoritative crypto education platform dedicated to newcomers and cryptocurrency beginners. The countrys status as a third world country and its harsh environments have hardened the people who live in it and have helped them subconsciously develop an unbreakable will to show up at work and give their all every day.

Cryptocurrency offers unique tax planning opportunities for accountants. Income Tax is a tax on all yearly profits arising from property profession trades or offices or as a tax on a persons income emoluments profits. According to the Izvestia newspaper officials at both the Russian Economic Development Ministry and Economy Ministry believe that mining fits well with the definition of a business activity and its recognition as such would allow authorities to regulate the sphere.

Read the top international tax journal for tax specialists and browse past research. 10 cryptocurrency market by end-user industry page no. Donate appreciated crypto assets to qualified charities to.

If you are living in the Philippines and are interested in joining the Bitcoin revolution yourself one of the easiest ways to buy Bitcoin is through the cryptocurrency exchanges outlined above. P10000 P200000 Difficulty. Seven ways to legally earn tax-free income The best possible scenario would be to simply not pay any taxes at all.

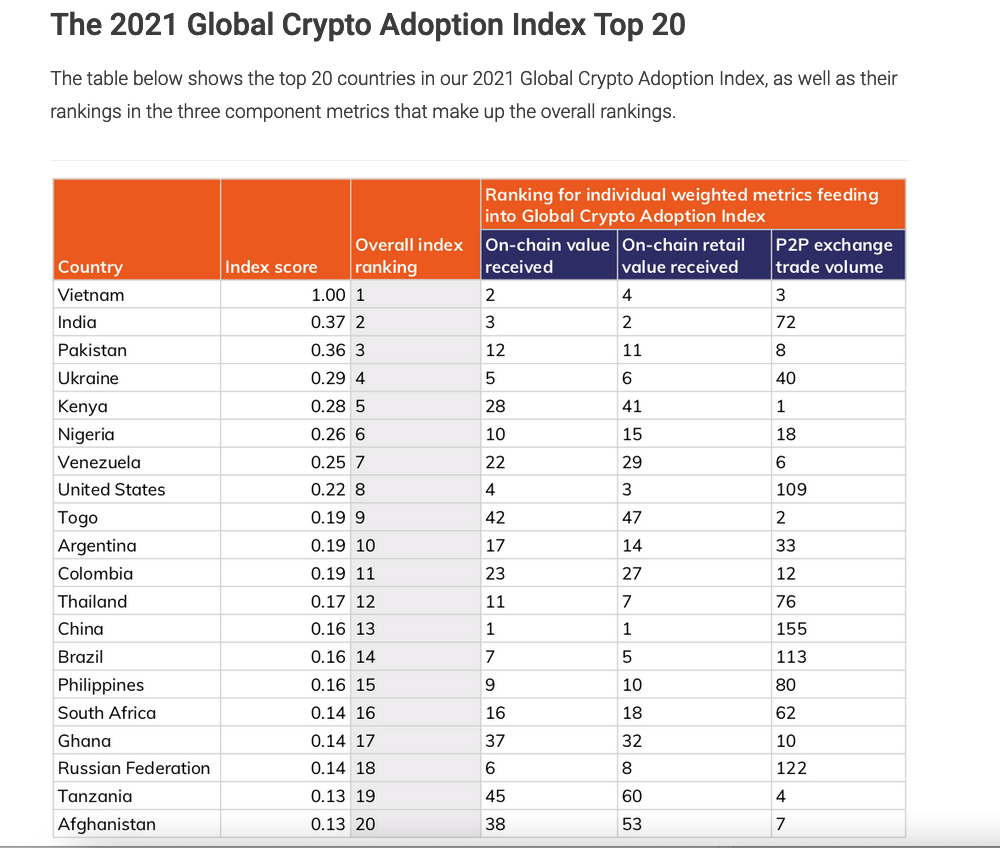

The Philippines ranked in the top 20 with a score of 16. These rates apply from January 1 2018 to December 31 2022. However despite the Read MoreFilipino Workers and Tax Computations in the Philippines.

There is a growing community of Filipinos interested in cryptocurrencies. Cryptocurrency markets in Philippines are relatively new and their availability are subject to local financial regulation. Wood is a tax lawyer representing clients worldwide from.

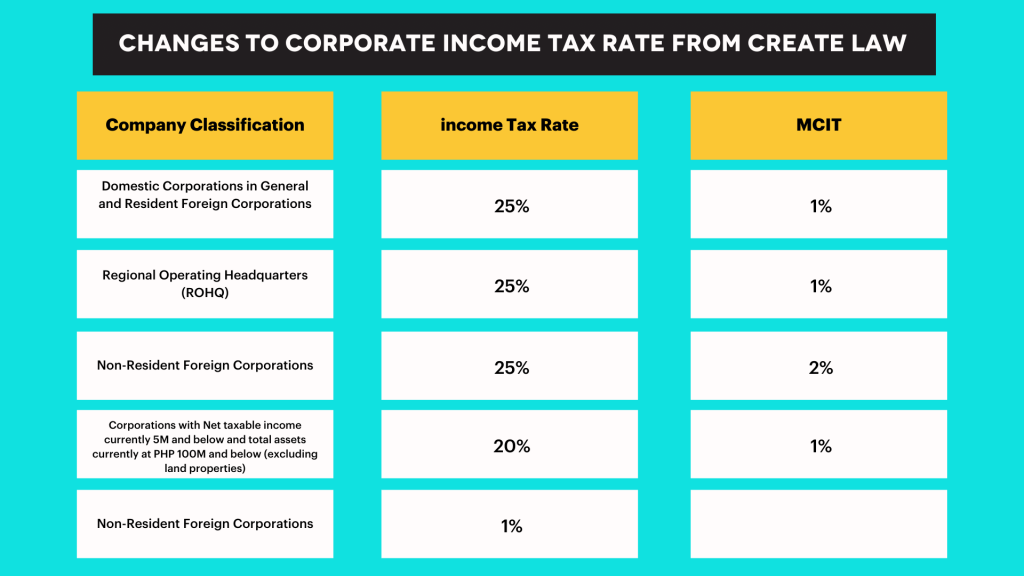

Tech companies which are duly registered in the Philippines are required to pay taxes. - 109 101 banking 1011 central banks across asia and europe are planning to launch digital currencies for future payment systems and cross-border transactions 102 real estate 1021 current procedures for searching and leasing properties in commercial real estate cre industry can. Design Technical and Marketing.

The latest breaking international news from Gulf News the UAEs No1 English speaking newspaper.

Cryptocurrency Taxation In The Philippines An In Depth Guide

The Most Crypto Friendly Tax Countries Wanderers Wealth

Cryptocurrency Taxation In The Philippines An In Depth Guide

Is Bitcoin Taxable In Canada Toronto Tax Lawyer

9 Exchanges To Buy Crypto Bitcoin In Philippines 2022

Earn Interest And Spend Your Crypto Crypto Com 2020 Philippines Crypto Debit Card Youtube

Taxation Of Cryptocurrencies In The Philippines How Are Virtual Currencies Regulated Blockchain Conference Philippines

Cryptocurrency Taxation In The Philippines An In Depth Guide

Cryptocurrency Taxation In The Philippines An In Depth Guide

The Most Crypto Friendly Tax Countries Wanderers Wealth

Taxation Of Cryptocurrencies In The Philippines How Are Virtual Currencies Regulated Blockchain Conference Philippines

The Most Crypto Friendly Tax Countries Wanderers Wealth

Getting Paid In Cryptocurrency Learn The Tax Laws

New Crypto Tax Law Good For Some Bad For Others Nasdaq

Cryptocurrency Taxation In The Philippines An In Depth Guide

Taxation Of Cryptocurrencies In The Philippines How Are Virtual Currencies Regulated Blockchain Conference Philippines

The Most Crypto Friendly Tax Countries Wanderers Wealth

Taxation Of Cryptocurrencies In The Philippines How Are Virtual Currencies Regulated Blockchain Conference Philippines